It isn’t news that pharma’s business model is in trouble, but a new report from Evaluate and number crunching from Endpoints show the size of the problem.

Pharma depends on innovation, which is why it turns to biotech as the powerhouse of novel technologies. About 65% of recently drugs come from small life sciences companies according to a report from HBM Partners. But despite this shift towards biotech, Big Pharma’s business is in trouble as it is failing to recoup the money it invests in R&D.

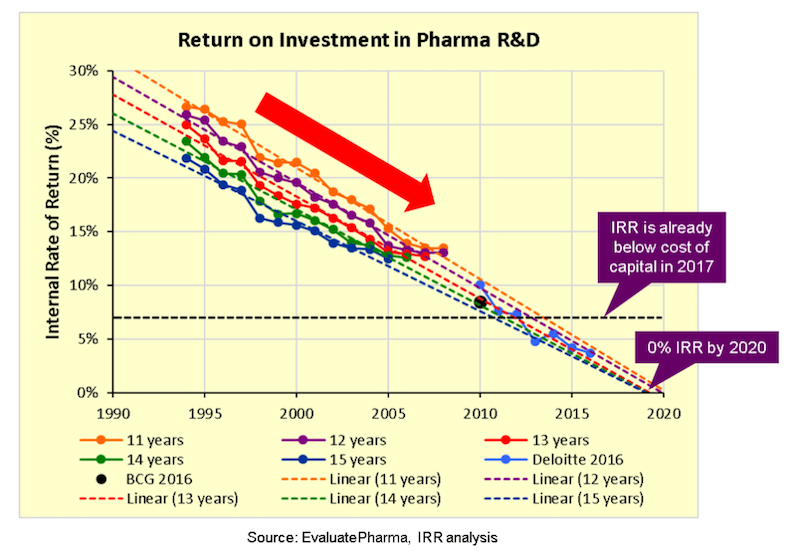

To determine the scale of the problem, Kelvin Stott, writing for Endpoints News, analyzed the productivity of Big Pharma by looking directly at their Profit & Loss performances. Large companies like Deloitte and BCG have been examining the internal rate of return (IRR) on investment, which Stott writes “is highly complex and convoluted (and thus subject to doubt).” (He goes through quite a thorough model analysis in the article.) Moreover, his return calculation includes the future R&D costs — it’s an optional use of profits that consequently might be omitted from other calculations.

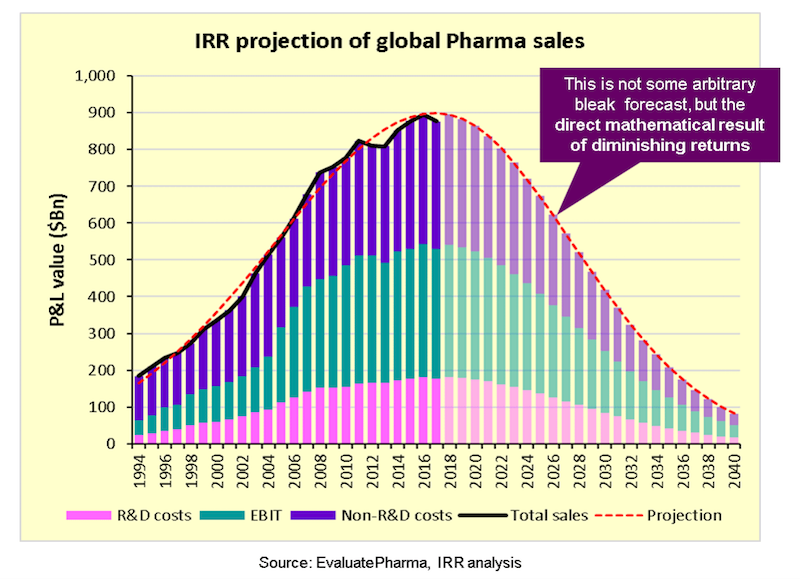

So what did he find? Not only is the return on investment in pharma rapidly declining, but it may well hit 0% by 2020. And that’s not even the bottom: If you invest in a drug and it fails, that’s a return of -100%. Now think about how an estimated 90.4% of drugs fail between Phase I and market approval, and a return of -90% might not seem so outlandish.

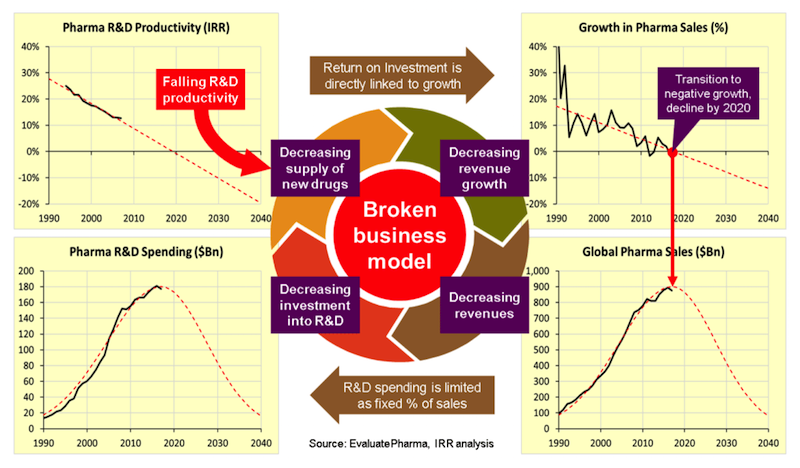

Stott believes this phenomenon is described by the Law of Diminishing Returns, which states that after all the low-hanging fruits are picked, returns will decrease because those that are higher up are harder to reach. In biotech, approved treatments set the bar increasingly higher in fields like cancer, diabetes and heart disease, and the fruits that remain are tough targets like complex rare diseases and neurological diseases.

These decreasing returns translate to a total failure of the current pharma business model. As Stott describes, decreasing returns on investments harm (sales) growth, and since R&D spending is a fixed percentage of sales, less money goes into developing new drugs, which further shrinks the pipeline and makes it even more unlikely that a pharmaceutical company will come up with a winning drug. The fate in store for the pharmaceutical industry is, according to Stott, that it will “shrink out of existence.” But, he reminds, the industry itself was born out of another failing one — the chemical dye industry — so he sees hope for pharma in self-reinvention. The most likely evolution will be into an industry built around cell, gene, and immunotherapies, which may in turn eventually give way to one for tissue engineering and regenerative medicine. In short, he concludes, pharma must “adapt or die!”

Images via Endpoints News and Gearstd / shutterstock.com

SaveSave