Looking to expand your partner network with the latest in the field of Hemophilia? Consider joining Inpart's global network for free.

Best in Biotech 29 Apr 2025

Six biotech companies leading the charge in hemophilia treatment

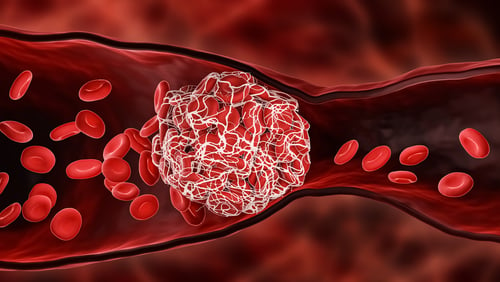

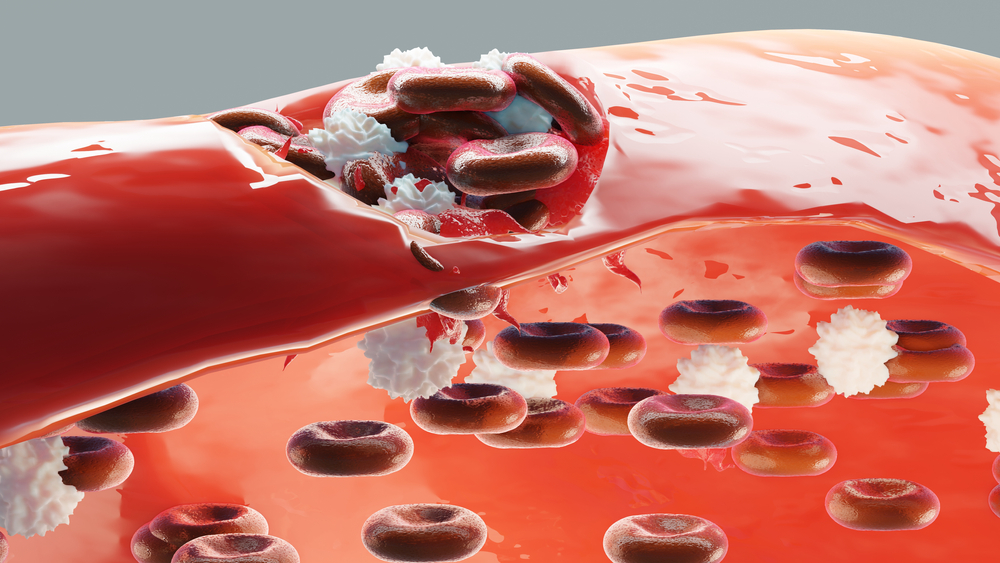

Discover six hemophilia companies developing new treatments for the genetic bleeding disorder, from gene therapies to RNAi therapies.