Newsletter Signup - Under Article / In Page

"*" indicates required fields

Update (23/05/2018): Investors have fully subscribed Celyad’s global offering of shares on NASDAQ and Euronext Paris, making the company raise a total of $54.4M (€46M) to support the development of its CAR-T technology.

18/05/2018

Celyad has raised €40M ($47M) in a global offering, which could help the company keep up with large competitors amidst recent large acquisitions in the CAR-T space.

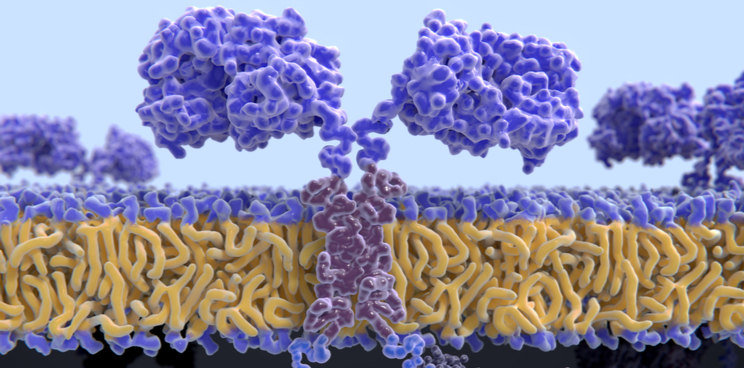

Belgian biotech Celyad has raised substantial funding on Euronext Paris and the NASDAQ to support its CAR-T cell therapy, which can be applied to both solid and blood tumors. CYAD-01, its most advanced drug candidate, is currently in Phase I trials. The funding could help Celyad keep up with other CAR-T developers.

For example, Celyad’s major competitor in off-the-shelf CAR-T therapies, Cellectis, had already entered clinical trials for its technology before Celyad and has partnered with Servier and Pfizer.

Big pharmaceutical companies are also becoming increasingly interested in CAR-T therapies. Last year, Gilead acquired Kite Pharma for a jaw-dropping €11Bn ($11.9Bn). Earlier this year, Juno Therapeutics was acquired by Celgene for €7.4Bn ($9Bn). While Cellectis stock rose by 12 % in the wake of the acquisition, Celyad did not enjoy a similar boost.

However, Celyad has been actively seeking support from big industry players. Last year, the company entered into a non-exclusive license agreement with Novartis worth up to €88M to give the pharma company access to its cell therapy patents. Perhaps the current funding could give Celyad the pick-up it needs to keep up with competitors.

Published on 18/05/2018 and updated on 23/05/2018

Image by Juan Gaertner/Shutterstock